How To Buy a Home Without Waiting for Lower Rates

buying myths

buying myths

Many people are hoping mortgage rates will come down before they buy a home. But will that actually happen? According to the latest forecasts, experts say rates will decline, but not by as much as a lot of people want.

The good news? Even if they don’t drop substantially, there are still ways to make buying a home more affordable.

A few months ago, experts were forecasting mortgage rates could dip below 6% by the end of the year. But recent projections suggest that may not happen after all.

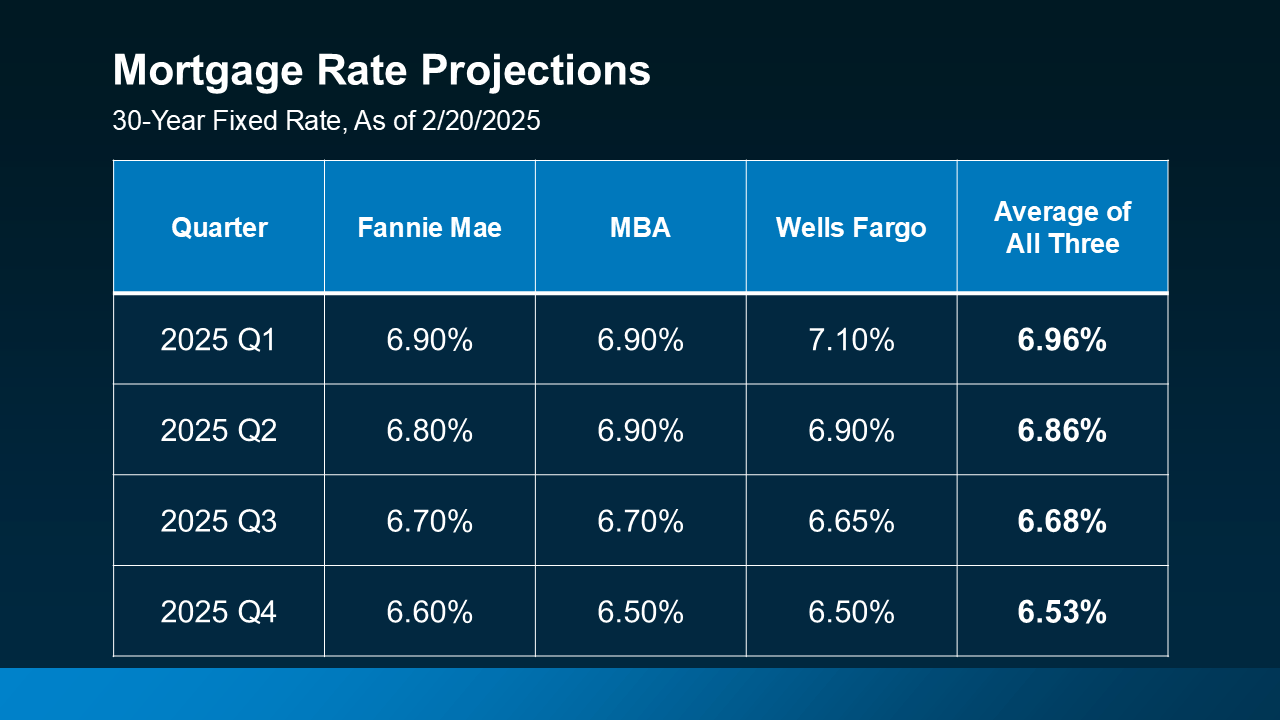

While mortgage rates are still expected to decline some later this year, projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo now show them stabilizing closer to the 6.5% to 7% range (see below):

That means if you’re holding off on buying a home in hopes of much lower mortgage rates, you may be waiting a while. And if you need to move because something in your life has changed, like a new job, a new baby, or a marriage – waiting that long may not be an option.

That means if you’re holding off on buying a home in hopes of much lower mortgage rates, you may be waiting a while. And if you need to move because something in your life has changed, like a new job, a new baby, or a marriage – waiting that long may not be an option.

Since rates aren’t expected to decline as much as originally expected, it may be worth considering alternative financing options that could help you get into a home sooner rather than later. Here are three strategies to discuss with your lender to see if any of these make sense for you:

1. Mortgage Buydowns

A mortgage buydown allows you to pay an upfront fee to lower your mortgage rate for a set period of time. This can be especially helpful if you want or need a lower monthly payment early on. In fact, 27% of agents say first-time homebuyers are increasingly requesting buydowns from sellers in order to buy a home right now.

2. Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) typically start with a lower mortgage rate than a traditional 30-year fixed mortgage. This makes them an attractive option, especially if you expect rates to drop in the coming years or plan to refinance later.

And if you remember the housing crash, know that today's ARMs aren’t like the risky ones back then. Lance Lambert, Co-Founder of ResiClub, helps drive this point home by saying:

“. . . ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

In simple terms, banks used to give loans without checking to see if buyers could afford them. Now, lenders verify income, assets, and jobs, reducing the risks associated with ARMs compared to the past.

3. Assumable Mortgages

An assumable mortgage allows you to take over the seller’s existing loan — including its lower mortgage rate. And with more than 11 million homes qualifying for this option according to U.S. News, it’s worth exploring if you want or need a better rate.

Waiting for a big decline in mortgage rates may not be the best strategy. Instead, options like buydowns, ARMs, or assumable mortgages could make homeownership more affordable right now. Connect with a local lender to explore what works for you.

How does this impact your homebuying plans this year?

Stay up to date on the latest real estate trends.

baby boomers

April 15, 2025

Your Tax Refund Can Help

buying myths

February 24, 2025

Creative Financing Options in Today’s Market

first time homebuyers

January 8, 2025

What Energy Efficient Features Do Buyers Want?

first time homebuyers

March 27, 2024

Mastering the Art of Moving: Expert Tips for a Seamless Transition to Your New Home

homeowners

March 20, 2024

Building Wealth, Creating Roots: The Advantages of Homeownership Over Renting

life enrichment

March 11, 2024

Spreading Sunshine: Embracing the Ripple Effect of Random Acts of Kindness for a Brighter World

first time homebuyers

February 20, 2024

Getting the Most Bang for Your Buck: Home Upgrades and Chill Returns

for sellers

August 31, 2023

buying myths

August 24, 2023

Creating lifelong relationships by providing the finest personal service and fulfilling all my clients' needs and unexpressed dreams one house at a time. Real estate is a complicated and emotional process, that’s why I’m there for my clients, holding their hand every step of the way.